Has Covid Killed Insurtech?

Our latest blog, written by Client Partner, Matt Ferguson looks at the impact that Covid-19 has had on the insurtech market. Has it flat-lined? Take a look and see:

Ok, so put the click bait style delivery aside for a moment – it’s an interesting question. Not least because we’ve heard it from more than one of our customers recently as Covid-triggered strategic reviews shift into market scanning in this changing landscape.

There’s certainly no shortage of granular reporting on the YoY, QoQ and sector trend comparisons for Q1 and, increasingly Q2. But in order to answer the question in a more meaningful way requires a broader view of the data available and to fundamentally look at the term ‘insurtech’.

By the way, the answer to the original question is a resounding, ‘No’.

Unless of course, the emergence of Covid-19 has coincided with insurance companies universally having defined all of their problems, established clear innovation strategies to solve them, and developed robust delivery plans to build the solutions themselves. Whilst migrating all of their staff to work from home.

No, there are simply too many genuine problems to solve with too much tangible value to both customers and incumbents, and too little resource and/or capability to solve them in-house. And therein lies commercial opportunity for the agile and unencumbered tech innovator and their backers.

I choose my words carefully here (tech innovator) as in order to answer the exam question requires us to revisit the term – what does ‘insurtech’ even mean any more? I mean insuretech. Sorry, InsurTech.

See my point?

Insurtech, noun – A company using technology to disrupt the insurance industry

We could devote a lot of time to exploring this. But, for the purposes of this blog, the dictionary definition is far less important than what’s really of interest to insurance companies – the value that tech innovation offers to their business. Be that defined in terms of inspiration, education or informing decisions on whether to build in-house, acquire or partner to deliver solutions.

And that’s where we have to go beyond simply the traditional insurtech label. Not because it’s not relevant, but because the needs of businesses in assessing opportunity and risk are more varied and nuanced:

- Are customer’s expectations set by what good looks like in insurance? No.

- If you’re looking for inspiration do you look solely within your country? Absolutely not.

- Would you exclude global tech giant activity from market analysis? I really hope not.

In its purest form, the label is too narrow in focus to help insurance companies with the challenge of growing consumer preference in a crowded and largely undifferentiated market. To identify where competitive advantage does or could lie in future, requires a broader approach to assessing the market. We think there’s a more effective way to define what’s of value – quite simply:

Technology or innovation that advances – whether directly or indirectly – the insurance industry.

In practice, this means that we would include any start or scale up that either has a current or near-term insurance proposition in our analysis. It naturally expands the data set, but in doing so also increases the value of market scanning activity.

The H1 2020 headlines

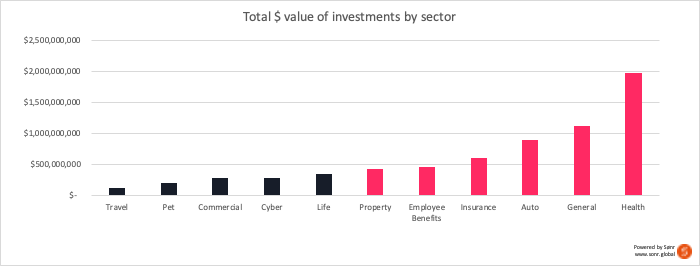

If we apply this approach to the H1, the headlines are clear. Covid-19 has definitely impacted the world of tech innovation and has great Impact on insurtech, but it’s very much alive. H1 saw a total of:

- 254 investments

- $6.6 billion invested

- $25.9 million mean deal size

- The most common raise being Seed – accounting for 20% of all deals

- Health – the standout most heavily invested in sector – represented:

- 31% of all deals

- 30% of all investments

- GI, Auto, Commercial, Employee benefits and Property were the next 5 most invested in sectors

Kicking off 2020

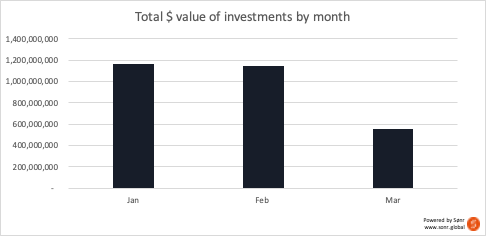

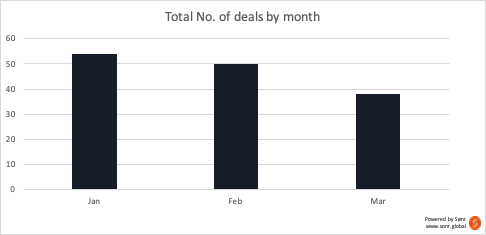

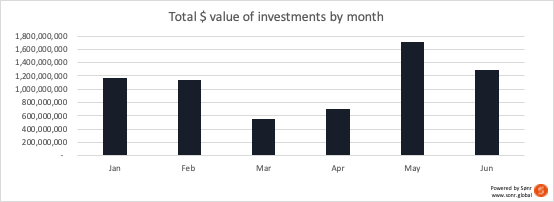

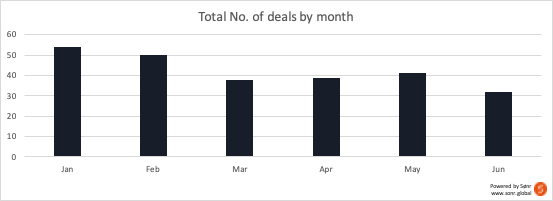

As ever, the devil’s in the detail. So, to give context to any comparative analysis, let’s take a look at the highlights of Q1:

- 142 investments

- $2.9 billion invested

- $20.2 million mean deal size

Certainly, the impact of covid-19 on insurtech was not being fully felt outside of China, early in the quarter. But it’s clear to see a significant impact on investment activity in March with a c50% fall in total investment value and c40% fall in the number of deals. This would make sense given the impending reality of lockdowns looming and attention focussing on dealing with BCPs and preserving capital. What deals did progress in March were likely already in-flight and were at comparatively lower average values.

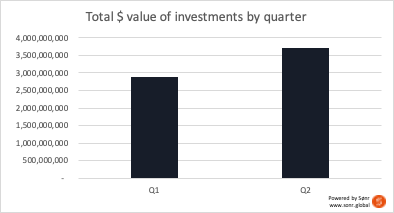

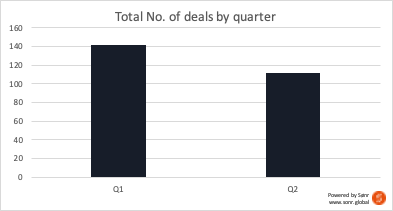

Q2 investment accelerates past Q1

By comparison, Q2’s activity included:

- 112 investments – 21% fewer deals than Q1

- $3.7 billion invested – 30% more than Q1

- $33.1 million mean deal size – 64% increase on Q1

By April, the impact of covid-19 on insurtech was understandably more pronounced, globally and we can see the impact of covid-19 on insurtech both in terms of the investment trends and also heard it from our insurance and investment friends:

- Corporate BCPs in Europe and NA in particular were in full swing – dealing with operational demands of enabling remote working whilst dealing with increased service demands

- Investors doubled down on ensuring their portfolios were secure, ensuring they had a 12-24mth cash runway and all but stopped new conversations and, on the whole closed off late stage negotiations

- Consequently, April saw investment activity, both in terms of volume and value remain relatively consistent with March (albeit with a slight increase in total invested)

- Investment totals bounced back – accelerating through May and June although the number of deals from March to June remained consistent

- Interestingly, we also saw the rise in investment tourism – where investors from other sectors entered into the insurtech space to deploy capital in sectors/ventures growing in spite of the pandemic

83% of investments went into startups/scale-ups from 3 countries

- 3 countries accounted for 84% of all $ investments during H1 – US, China and Israel

- US accounted for the vast majority – 70% of all $ investments ($4.5 billion)

- China – 9% ($563 million)

- Israel – 5% ($328 million)

Clearly the fact the US market accounts for such a massive % of activity is hugely significant. But similarly, the fact that 30% of investments came from all over the globe (led by China and Israel) also tells us we need to be looking far and wide for inspiration. It’s also interesting to think about what this trend means for the industry closer to home – the UK investments comprising 5% ($327 million). If we’re not able to step up our investment game we will potentially be consumed by scaling tech from the US and Asian markets expanding into Europe.

55% of all deals were Early stage investments

The majority (55%) of H1 deals were in early stage investments. Incorporating Angel, pre-Seed, Seed as well as Series rounds A and B, these were made into startups typically looking to validate product:market fit, unit economics and/or have gained market traction and are looking to grow. Of those Early stage deals:

- 47% were Angel, pre-seed or Seed investments or earlier (representing 26% of all H1 deals)

- 53% were Series A and B investments (representing 29% of all H1 deals)

This is significant in the context of industry ‘health’ as investors are sufficiently excited (and confident) about the future potential of these early stage businesses for them to comprise the majority of their deals.

Summary

So, in summary there are a number of key takeaways here:

- No, the insurtech has not been killed by Covid. Whilst we saw a comparative reduction in deal volumes in Q2 compared with Q1, total investments in Q2 were 29% higher. Figures aside, I haven’t seen a seismic shift in the needs of insurance companies during this period – if anything its placed digital innovation higher on the agenda.

- The future’s looking positive – the proportion of early stage deals show that investors see longer-term potential in a significant number of start and scale ups. Similarly, recent IPO and acquisition activity (see Lemonade and Brolly) are important success stories for the market to see.

- The future’s going to be interesting – unsurprisingly, the Health sector fared well as insurance companies sought to meet Covid-driven demand for remote services (particularly tele-health). But it wasn’t the only sector to see strong investment.

This, in combination with the inevitable changing market conditions for insurers, their customers and therefore start/scale ups alike, mean that it’s going to be interesting to look more regularly at how this picture unfolds.

- We need a clear and balanced view of innovation – whilst market sizes vary, we need to recognise that innovation happens globally. Local regulation and language aside, there’s inspiration well beyond your own location.

- We need a broader definition of where value lies for insurance companies – it’s time to look outside what’s now an echo-chamber of insurtech to the wider technologies being adopted by or could benefit the insurance industry

If there’s anything in this report that you’d like to discuss then please feel free to get in touch. We’re sitting on an incomparable amount of data in and around the world of insurance and can happily spin up market reports, do some further investment or trend analysis, or help out with your next board paper.

Either way – we’d love to chat.

[email protected]

07738 625337