Kiril Ivanov – Bright Union

This week our Spøtlight is on Kiril Ivanov, Co-Founder and Technical Lead of Bright Union. Bright Union is a Web3 Insurance Marketplace, enabling users to both buy and provide DeFi covers. Users can protect their digital assets against threats such as hacks, halted withdrawals and protocol failures, as well as provide liquidity, earning sustainable yields through the Bright Risk Index.

Hi Kiril, could you tell us a little about yourself and your journey prior to launching Bright Union?

I’m a technician and have been building software for 20 years. I was born in Belarus, graduated in the early days of computer science & artificial intelligence. I came to the Netherlands to join ING as a dev and subsequently spent multiple years in insurtech building software and services for insolvency regulation and integrated risk management services for AXA Unica and Allianz.

6 years ago, I got inspired by the idea of building a coded business model and I started experimenting with tokenization. I started the journey to build blockchain apps with a small European community that was adept in decentralised insurance concepts. The first proof of concept we’ve created was a train delay insurance protocol. It was fully on-chain, payouts were instant and permissionless, meaning that anybody could provide capital to buy and sell risks for international trains being delayed.

For SAA, one of the biggest Dutch insurance brokerage companies, we’ve built an app for community engagement. It entailed a loyalty system where loyalty points were tokenised on the blockchain. People could earn points by buying insurance, disclosing data and participating in prevention services (for instance if you have health insurance and you would install a smoke detector, you could unlock points).For me as an IT person, the possibility to build ‘financial lego’ attracted me tremendously. The nature of blockchain application with its open source nature allows seamless integration without any limit. It’s global by design. Solutions such as KYC, risk management, yield generation and risk pricing could be integrated at scale, in a quick manner, without permission.

Could you share how the idea of Bright Union came about/why it was launched?

The DeFi insurance concept proved to be viable and profitable early 2021. The growing market (current market cap $41B) became a honey pot for attackers, resulting in 3 billion worth of losses due to hacks in DeFi in 2022. Over 98% of the crypto assets are still uninsured, creating a huge potential. At the time I worked for SAA, where I met Michiel, my co-founder, we saw new insurance projects entering the wild west of finance. With Nexus Mutual leading the industry, projects aimed to help users effectively manage their tail-end risks. But the industry was fragmented, untransparent and we saw a big variety in terms, policies and pricing of risks.

We came to the conclusion that web3 insurance is the next big thing. Michiel has a nice track record of successful startups and tons of experience in traditional insurance and we decided to join forces to aggregate and accelerate the decentralised insurance market.

How does DeFi Insurance work and what is the role of Bright Union in the ecosystem?

Similar to traditional insurance, DeFi insurance protects crypto investors against risks in return for premiums. Instead of being governed by an insurer, premiums and payouts are handled decentralised. It’s a community based solution for hacks, set up as a mutual.

For German references, Bright Union is the ‘Check24’ of DeFi insurance and we’ve built a platform on the Ethereum blockchain that aggregates onto a single platform where users can compare, buy and sell insurance. On the buying side we’ve integrated with 8 coverage providers offering coverage for +240 protocols. So far, our partners have sold 98% of all covers and have paid over $20M in claims.

On the other hand we’ve built the Bright Risk Index (BRI) where anyone can provide capital to a risk pool and earn the insurance fees by being exposed to risk. It allows the native web3 audience to invest in DeFi insurance from their crypto wallet, and earn 5-15% yield for being an underwriter.

The BRI is a liquid tokenised position which represents a curated basket of diversified staking positions underwriting risks in the DeFi insurance markets. We saw it as our mission to increase capital efficiency in the DeFi space as the lack of liquidity is the biggest challenge of this industry.

What are the challenges traditional insurance face that can be solved on-chain?

We understand that accessing GenZ and offering a smooth customer journey is a key focus for many insurers. Insurance is still a push product and perceived as boring by the end user. Insurance companies attempt to approach the end user directly, but as this industry is low interest / low touch, and few touchpoints exist, data collection and doing proper risk analysis remains challenging. Data is seen as an asset to keep proprietary, making traditional insurance companies reluctant to share data. Even if they would share data, it would be hard to create a seamless experience, as companies operate on different systems with different definitions. The lack of transparency and speed in the industry results in suboptimal pricing and solvency, hindrance to offer a smooth customer journey, difficulty in assessing individual risks and risk portfolios and hard to offload risk from the balance sheet.

Blockchain offers a solution to the problems mentioned above. Our platform is built on the Ethereum blockchain, where all players transact on the same platform. Ethereum is the leading blockchain platform and provides access to a 55 billion dollar DeFi market. On-chain, transactional data is transparent, has the same definitions and all parties have the same access. For insurance companies this is a big opportunity for growth. Where insurance is part of a bigger offering, like with home related services (security, heating, fire prevention), all partners can access the same data in real time, thus reducing need for coordination and improving the customer journey. Sweeping of the chimney for instance will be logged in the blockchain, which is immediately visible to the insurance company. Or in case of water damage in the house, once a claim is assessed and logged in the blockchain, the repair service is automatically informed.

Using the blockchain also allows insurance companies to tokenise and offload all kinds of risks. Traditional insurers hold many special risks on their balance, which are difficult to sell, as risk assessment is complicated. If all data is visible, verifiable and definitions are the same, as is the case with blockchain, it becomes possible to securitise or tokenise assets and sell risk packages which are set up like our Bright Risk Index. Insurers that go on-chain have the opportunity to gain a unique understanding of the crypto world from a native Web3 company. Additionally they’ll have access to bespoke decentralised insurance products and gain entrance to a new asset class of which just 2% is covered. First movers will move from being a risk carrier, to a risk manager. The use cases are endless, and can be both geared towards a crypto native audience but also focus on traditional insurance.

Bright Union has recently been accepted onto The NXT:Customer Accelerator, run by InsurTech Hub Munich. Can you tell us more about that, and what you hope to gain from the experience?

As Bright Union, we believe that blockchain/ web3 and TradFi will integrate and become part of one new ecosystem. In the end, customers do not care about technology, but they care about solutions. Technology is an enabler of a good customer experience. Web3 brings some benefits to the Tradfi sector which are too good to ignore. Therefore, we would like to get in touch with insurance companies and brokers who are open to look at these benefits for themselves and their clients. Web3 is currently still very much focused on crypto and Defi. Because of the growing pains the crypto space is going through, we have decided to pivot and bring web3 solutions outside the crypto and Defi space. The insurance industry is a logical industry to use web3 solutions and with our web3 and insurance background, we believe we can offer real value add. NXT helps us to get to know more companies active in the insurance industry.

We see several touch points for cooperation with the insurance industry. Firstly, we can bring traditional insurance products and services on-chain, like with the home related insurance and services. The benefit of blockchain is that the integration between partners in an ecosystem is much easier and better than in traditional IT infrastructure. So for home insurance, the insurance company and its partners like a security company, damage assessors, repair services can all be part of the same IT environment and thus improving the customer experience significantly.

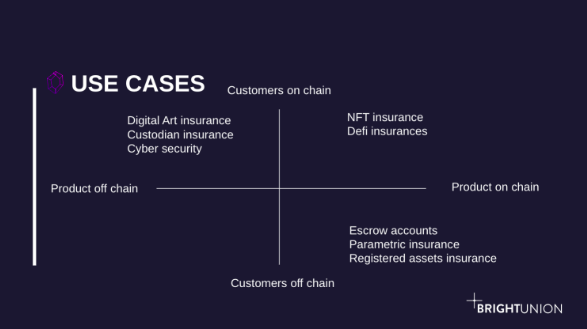

Secondly, we see the possibility for insurance companies to provide traditional insurance to their normal customer base who invest in web3 related services, like cybersecurity and digital art. Similarly to photography, art is also rapidly moving digital. These objects also require insurance. Although the art may be logged in the blockchain as unique item, a normal insurance could be provided to the owners of this art.

Thirdly, insurance companies could slowly move into real web3 insurance providing on-chain insurance for NFT’s, DeFi and metaverse assets. These insurances are probably for most insurance companies a bit further down the line in the future, given the billions that are invested, it is inevitable that these markets will mature and provide great opportunities for insurance companies. Generation Z is very much active in this space, so it is also a great place to find GenZ customers for traditional insurance products.

Finally, using blockchain within the insurance value chain can simplify the data exchange and risk transfers between insurance agents, brokers, insurance companies and reinsurance companies. By using the same definitions, and have transparency on the assets in the risk pool, it will be easier to offload risk pools from the balance sheet of an insurance company or reinsurance company. WIth our BRI we have shown that you can transfer diversified risk pools from insurance companies to private and institutional investors.

What do you hope to achieve with Bright Union in the next 12 months?

Currently the Defi markets are affected by 2022 events such as the Terra Luna and FTX collapse. It has shown that transparency is not only required on-chain but also in the way crypto companies are managed. It has taught us a number of lessons, namely that professionalisation of the industry is a must. Regulation we think will not only be inevitable but also needed to prevent these systemic events from happening again. At Bright Union, we see that more parties seek insurance for their assets, but the willingness to provide insurance has reduced due to the losses incurred. Liquidity providers require more clarity on the risks they are taking. Despite the downturn in Defi and crypto, we do still see growth in our sales volume. Because in a downturn, value is created by fundamentals like sales and market share, we do want to focus on these KPI’s.

At Bright Union, we strongly believe that open source blockchain technology has too many benefits to the insurance industry to ignore. So despite the current downturn in the market, it is inevitable that the industry will continue to develop. We will use this period to continue to build our business propositions and strengthen our ecosystem of partnerships.

In the short term, we want to be a technology partner for traditional insurance players to introduce them to web3 and co-develop new products. In the medium term, we will be looking at offering our solution to securitise risk pools to reinsurers and institutional investors. We have built the BRI, Bright Risk Index, where large diversified risk pools are securitised into small tradable instruments. This is a great way to transfer risk between insurers, reinsurers and institutional investors. With respect to the crypto market, we will be looking at integrating metaverse insurance providers and NFT insurance providers.

Finally, where do you see the future of DeFi Insurance going over the next 5-10 years?

As we indicated, blockchain has strong benefits which cannot be ignored. When all players in an ecosystem or value chain use the same back end, connectivity becomes very easy and cheap. Agents, brokers, insurers, reinsurers, claims assessors, repair services, etc. Everyone can be connected in real time with each other. In addition, all the data on that blockchain uses the same definition, which means everybody is talking the same language.. That is a huge benefit in the insurance industry. Finally, by decentralising the data, there is also only one version of the truth. So blockchain reduces costs, increases trust & speed and improves the transparency and transferability of risks.

We believe in the coming 5-10 years, DeFi insurance, traditional insurance and financial markets will move closer to each other and partly converge. In the end, it is about good customer propositions. Technology will be an enabler of good customer propositions. For business cases where blockchain brings benefits, it will be used in traditional insurance. If it makes sense to use a traditional insurance product for a DEFI customer, it will be offered and sold. Like the internet in the early days was separated from the traditional business world, now it has fully converged. We believe this will happen to Defi insurance as well.

If you’d like to find out more about Bright Union, please visit its Sønr profile, or you can check out its website.